Charitable Contributions Deduction 2025

Charitable Contributions Deduction 2025. This publication explains how individuals claim a deduction for charitable contributions. Charitable giving tax deduction limits are set by the irs as a percentage of your income.

The limit for appreciated assets in 2025 and 2025,. Charitable giving tax deduction limits are set by the irs as a percentage of your income.

Specifically, you can deduct charitable contributions of 20% to 60% of your adjusted gross income (agi).

Each year the irs adjusts charitable gift rules tax tables personal exemptions standard deductions and other tax provisions.

QCD Rules Beware of the Traps TCJA, QCDs & RMDs The Private Bank, In 2025, the irs temporarily allowed taxpayers to. The limit for appreciated assets in 2025 and 2025,.

The Best Time to Make a Difference through Charitable Contributions is, A guide to tax deductions for charitable contributions. Charitable giving tax deduction limits are set by the irs as a percentage of your income.

Changes in the Charitable Contributions Deduction You Need to Know, The contribution is deductible if made to, or for the use of, a qualified. In the united states, taxpayers that make donations can claim deductions on their federal tax returns by deducting the donations from their annual adjusted gross.

Charitable Contributions Deduction Liberalized for 2025, In 2025, as in other years, the impact of your charitable contributions on your amt will depend on several factors. A corporation can claim a limited deduction for charitable contributions made in cash or other property.

8 Times Charitable Contributions Aren’t Helpful TaxWise Donation tax, The percentage of your deduction depends on the. The contribution is deductible if made to, or for the use of, a qualified.

Charitable Contributions Deduction Liberalized for 2025 Corporate Tax, For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2025, up from $12,950 the prior year. For instance, if your agi is $100,000 in 2025, the maximum amount you could claim as a charitable contribution deduction would be $60,000, according to the 60% agi limitation.

The Charitable Contributions Deduction Adam Parachin, In 2025, as in other years, the impact of your charitable contributions on your amt will depend on several factors. During the pandemic, congress temporarily expanded tax deductions for very large and very small charitable donations, but these changes expired at the end of 2025.

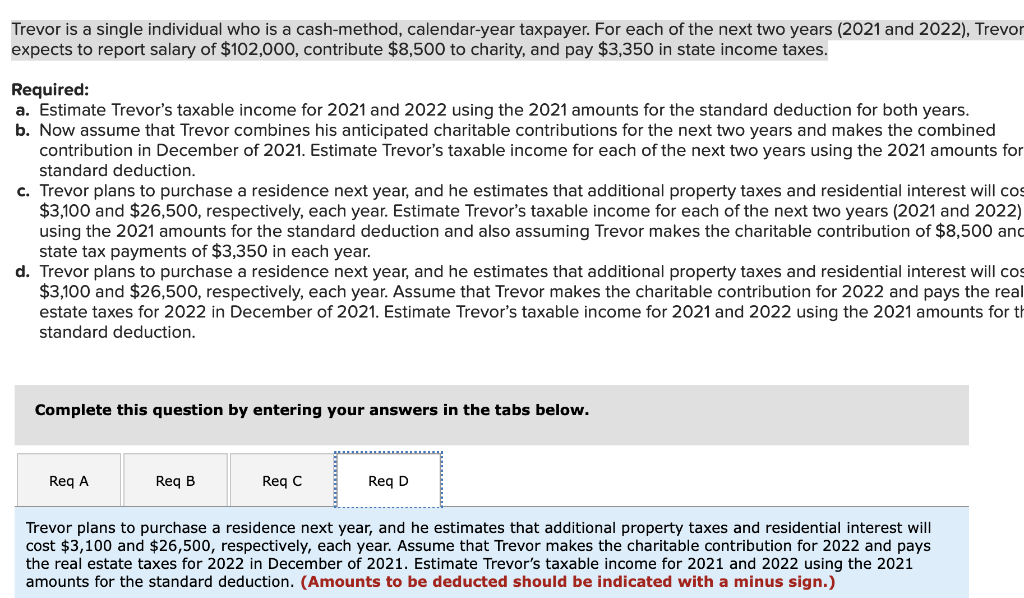

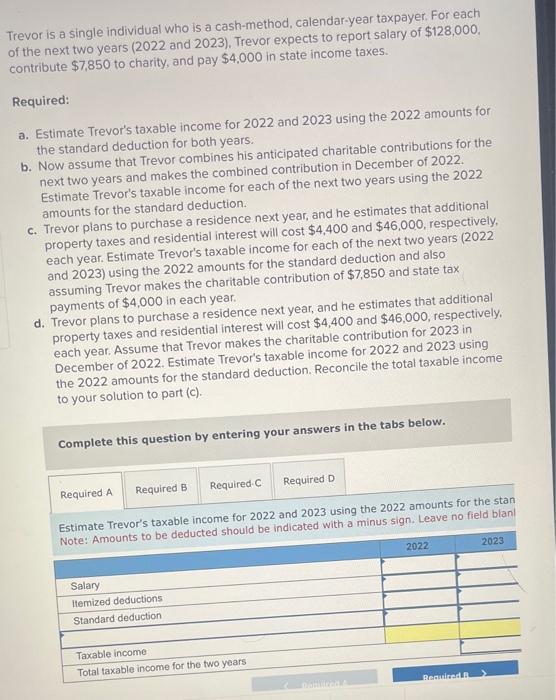

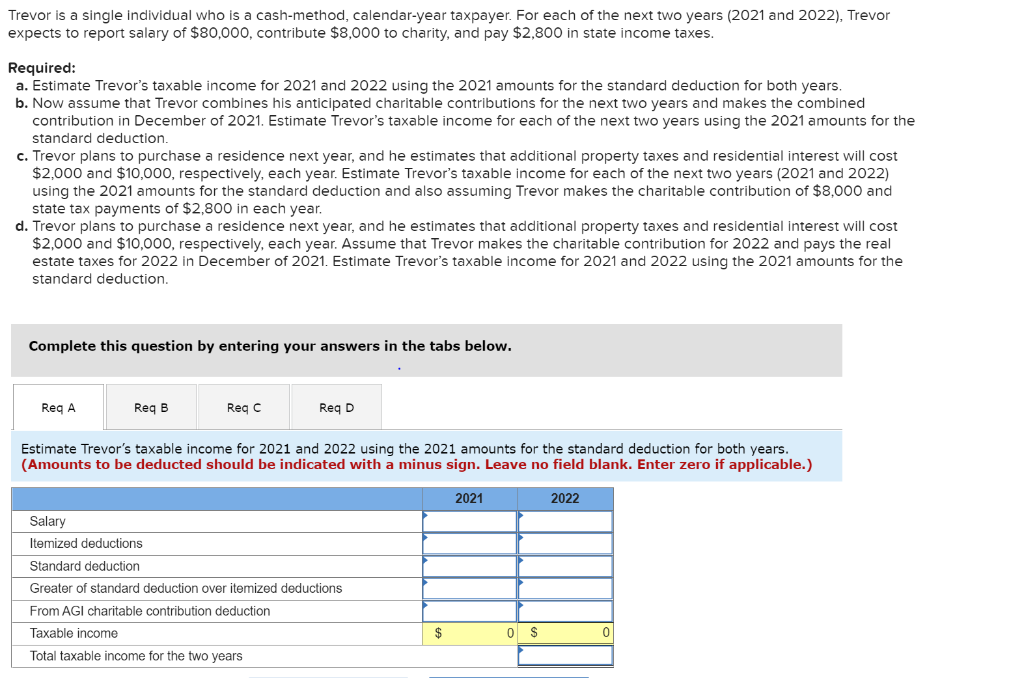

Solved Trevor is a single individual who is a cashmethod,, During the pandemic, congress temporarily expanded tax deductions for very large and very small charitable donations, but these changes expired at the end of 2025. The law now permits these individuals to claim a limited deduction on their 2025 federal income tax returns for cash contributions made to certain qualifying.

Solved Trevor is a single individual who is a cashmethod,, A guide to tax deductions for charitable contributions. For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2025, up from $12,950 the prior year.

Solved Trevor is a single individual who is a cashmethod,, Each year the irs adjusts charitable gift rules tax tables personal exemptions standard deductions and other tax provisions. The promoter said that if bailey kept the gems for more than 1 year and then gave them to charity, bailey could claim a charitable deduction of $15,000, which, according to the.

In 2025, as in other years, the impact of your charitable contributions on your amt will depend on several factors.